RePowerEU: from European energy dependence to opportunities related to the development of green hydrogen

by Marco Mencini, Senior Portfolio Manager Plenisfer Investments SGR S.p.A.

The war in Ukraine has highlighted the need for Europe to accelerate the diversification of energy sources in order to ensure greater independence and security in this area. On 17 May, the European Commission detailed the objectives of the RePowerEU plan that aims to rapidly reduce dependence on Russian fossil fuels and accelerate the energy transition. Among the objectives indicated is an increase of renewable energy generation to 45% of overall energy needs by 2030, compared to the 40% already envisaged under the Fit 55 Plan approved last year. The acceleration in the development of renewable energy goes hand in hand with the potential incremental production of green hydrogen generated through an electrolysis process powered by renewable sources to separate the oxygen from the hydrogen contained in the water. The development of green hydrogen production was already envisaged in the European Green Deal – the plan that aims to achieve net-zero greenhouse gas emissions by 2050 – according to which hydrogen should reach 80% of our combustable gases by 2050. On this front, RePowerEU aims to double the green hydrogen production target set for 2030 to 10 million tons per year, while importing an additional 10 million tons from abroad, thus replacing up to 50 billion cubic meters per year of Russian gas currently imported. This represents enormous growth potential if we consider that today green hydrogen makes up only 1% of total hydrogen production.

The development of green hydrogen production, though debated for the last two decades, has been stymied by excessive costs. These costs have progressively fallen, especially in the last decade (-60%) and it’s estimated that they should further halve by 2030 (Source: International Energy Agency).

The President of the European Commission, Ursula von der Leyen, has stated that “Because of the current rise in gas prices that we see, green hydrogen today can even be cheaper than grey hydrogen. Our goal is to bring the cost below €1.80/kilo by 2030”.

At Plenisfer we believe that the political will to support this energy source combined with ongoing technological developments and the reduction of production costs have, after decades, created the conditions for an effective deployment of green hydrogen.

Investment opportunities in real assets related to green hydrogen

We believe that the development of green hydrogen will offer investment opportunities in at least four areas of the real economy:

- Infrastructure

- Production technology

- Related industries that will benefit from hydrogen use

- Platinum

Infrastructure

Overall, the European Union will invest €300 billion in green hydrogen, about €70 billion of which will be allocated to infrastructure for the production, storage and transport.

In particular, the infrastructure for the transport of green hydrogen, essential for its real use, is still very reduced and is mainly limited to the connection between the production sites of green hydrogen and the neighboring industrial areas that use it.

Hydrogen infrastructure construction is therefore still in its early stages. There is a total of 5,000 km of distribution network in the world, of which more than 90% are located in Europe and the United States. European gas grid operators are therefore considering expanding the infrastructure to almost 40,000 km by 2040, 69% of which through the conversion of existing pipelines.

Hydrogen needs to be liquified or compressed to be transported and there are also several studies underway to make the transport more efficient: among these there is the use of ammonia as vector transport for hydrogen.

Ammonia transport network such as marine and land infrastructures, could therefore also be used for hydrogen. At Plenisfer, we believe that the development of the infrastructure needed to transport green hydrogen can offer new investment opportunities.

Technology at the service of hydrogen production

To date, the installation in Europe of electrolysis systems capable of generating 58 GW by 2030 is planned, an increase of almost sixty fold over the 2021 output.

This is a significant goal, but still insufficient: in order to achieve energy independence from Russia, 400 GW should be installed. Governments are therefore increasing their plans to fund the construction of production plants, and not just in Europe: despite the lack of an explicit national strategy on green hydrogen, it is estimated that China will be the largest single market for electrolysers in 2022, generating up to 66% of the expected global demand (source: BNEF). It will therefore be necessary to carefully monitor the technological developments related to the rising production of hydrogen. On this front, the electrolysis realized with the family of polymer electrolyte membrane technologies (PEM) in the last 5 years has quickly gained market share (+32% in 2020 according to the IEA) compared to the traditional electrolysis of alkaline water rich in nickel (AEL). This development is due to the greater versatility of the PEM technique, the lower energy consumption and its rapid start-up and loading times, making it more effective in the production of green hydrogen connected to intermittent energy sources such as solar or wind. It is difficult today to predict what new solutions will emerge in the future production of green hydrogen, but emerging technology is certainly an area to be monitored carefully.

Sectors that will benefit from the spread of green hydrogen

There are many potential areas of use of hydrogen and at Plenisfer we believe that two sectors in particular will benefit from its deployment:

• Storage of energy from renewable sources: because renewable energy sources are usually intermittent, storage systems are essential to support their adoption. The Energy Storage Association points out that hydrogen energy storage systems can store from 1 GWh to 1 TWh of energy, unlike battery storage, which typically ranges from 10 KWh to 10 MWh. We therefore expect significant growth in such storage systems which could in turn support the further deployment of energy from renewable sources.

• Freight transport: Hydrogen is a well-known fuel, but it requires large housing spaces for pressure containment and flow management systems. It is therefore particularly suitable for heavy transport, long-haul vehicles, where batteries are not competitive today in terms of cost, efficiency and autonomy. We expect that an uptick in hydrogen use may mean growth in this transport niche.

Platinum

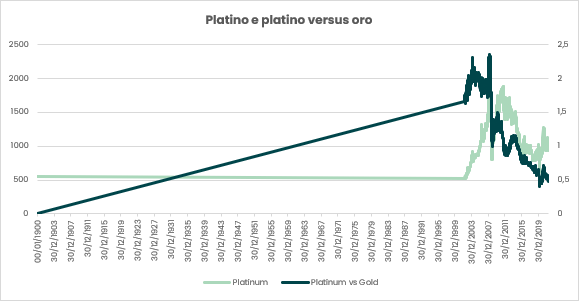

At Plenisfer, we believe that the adoption of green hydrogen will buttress platinum prices, which today hover around $950 per ounce.

This precious metal is used in PEM electrolysis which, as described, is expected to expand. We estimate that new PEM installations could generate additional demand for platinum (c. 300,000 ounces per year through 2030), while fuel-cell demand related to the transport and energy storage sector (focused only on European targets) would lead to additional demand of between 2.5 million ounces and 6.2 million ounces. To date, the annual supply of platinum is equal to about 7 million ounces, a value close to today’s overall demand, despite the decline in demand for platinum linked to the slowdown in the automotive sector, traditionally the principal industrial user of platinum.

Even taking into account the lower demand from the automotive sector, at Plenisfer we believe that the adoption of green hydrogen could lead to a deficit between growing demand and limited supply. The offer is in fact characterized by:

• Geographical concentration: 80% of the world’s economically viable reserves are located in South Africa, which suffers from electrical grid issues that penalize mining. Southern Africa is the only primary source of platinum, while in Russia and North America it is mined as a by-product of other metals (mainly nickel and palladium).

• Few producers: Anglo Platinum alone accounts for almost 50% of the global supply.

• Limits to growth in supply: the development of new extraction sites takes about 10 years.

Growing demand and limited supply could therefore lead in the coming years to a strong reversal of the underperformance (-75% since mid-2008) of platinum compared to the precious metal par excellence, namely gold (Source: Bloomberg):